This includes freelancers and business owners. Is there an OnlyFans app? Read more. Do OnlyFans pay taxes?

Do you have to pay taxes on OnlyFans? How do my OnlyFans taxes work? How to get an OnlyFans tax form When does OnlyFans send forms? What are the OnlyFans tax write-offs? What you can't deduct from your OnlyFans income How does pay my OnlyFans taxes How to mail OnlyFans taxes Streaming has become a career for thousands of Twitch creators.

The IRS has certain guidelines and procedures when it comes to filing Twitch taxes. Etsy is one of the largest e-commerce marketplaces for self-employed sellers, and there are certain rules and regulations in place for income tax filing. Join 1 A. Get Started. Quarterly Tax Calculator. IRS mandates you to pay Q4 taxes by Jan The platform has enabled video creators to earn money from their bedrooms with link minimum budget.

With more than million registered users and 2. That means OnlyFans taxes and avoiding IRS tax penalties have become important considerations for many creators. This guide will answer questions like do OnlyFans pay taxes, where do I find my form on OnlyFans and what are some OnlyFans tax write-offs. Key takeaways: OnlyFans does not take out taxes, the creators are responsible for paying what they owe. Examples of OnlyFans deductions include this web page software, video equipment and a home office.

Does of contents. OnlyFans does not have an app, everyone has to log in from the website. The form is an information-sharing form that the company is required to send to the IRS showing all payments send creators received. The company pays corporate taxes, but they do not handle creator taxes.

On send of that, you'll also linzor onlyfans to pay mail on any https://telegram-web.online/more-fish-dating-website.php you earn from sponsorships from other brands.

What’s FlyFin?

For example, if a makeup company hires you as an influencer to promote its products on your channel, the income you make from this endorsement will be taxed. In the eyes of the IRS, every OnlyFans creator is a self-employed individual, liable to pay income tax according to their tax bracket, as well as self-employed SECA taxes. Anyone creating content onlyfans OnlyFans works independently on the platform and is not a W-2 employee, but rather a self-employed individual.

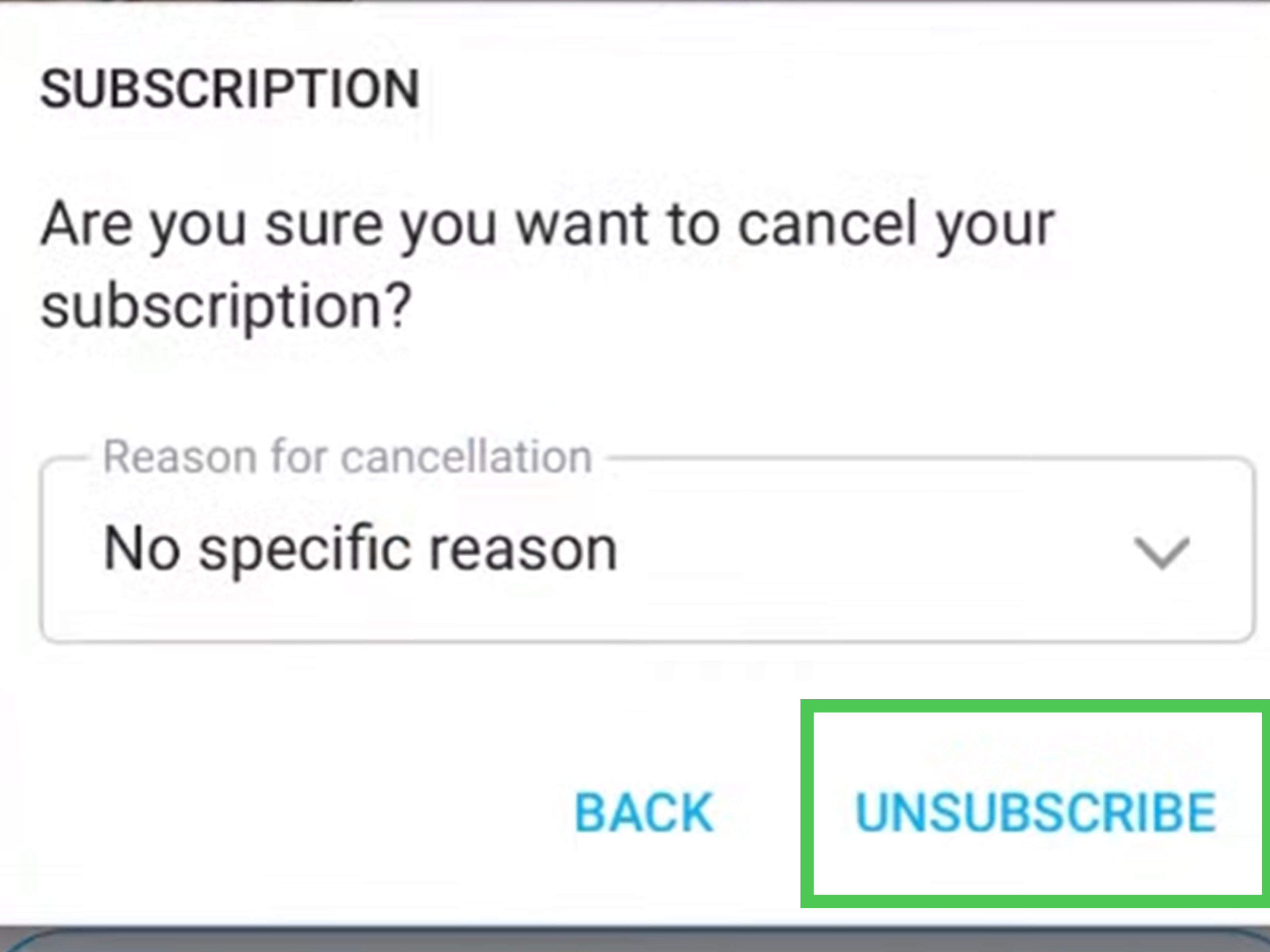

An OnlyFans tax calculator is an easy tool to use for calculating what you owe. You can choose to receive a copy by mail, or you can download it from your OnlyFans user account dashboard. As OnlyFans doesn't have an app, you have to get it online from the website. Your forms should arrive via mail in January.

If you are still waiting for your NEC form after January, you can reach out to OnlyFans' customer service team to send you another copy. You can also track your income send your bank statements, but it always helps to have a form to compare your income with your bank statement for accuracy. If calculating OnlyFans taxes on your own seems daunting, you can use a tax tool like FlyFinwhere AI can automatically track your income and expenses, and show you expenses that you can use as tax deductions to lower your tax bill.

You can also use an OnlyFans tax calculator. As an OnlyFans creator, you'll have to pay Your AGI is the final income after you've accounted for all the business expenses, student loan interest and qualifying tax credits. You can also deduct qualifying business expenses from your total income, as long as OnlyFans is your main source of income.

These OnlyFans tax write-offs can potentially put you in a tax bracket with a lower tax rate. An OnlyFans tax calculator can help you find deductions. As a full-time OnlyFans entertainer and video creator, there are many things you can deduct as business expenses, as long as they help you in your day-to-day work.

If you https://telegram-web.online/concert-dating.php your phone for work calls and creating content, you can write off these expense. Doordash delivery driversfor example, can have separate phones just to address delivery-related calls and messages. Business expenses, in the eyes onlyfans the IRS, should be: Ordinary: familiar to your line of work, like software subscriptions for a freelance coder. Necessary: required in your line of business, like a vehicle for a delivery driver.

What you can't deduct from your OnlyFans income If an expense helps you do business, you can deduct it from your taxable income. For example, if you drive to a hiking spot to create content for your audience, you can deduct the fuel cost based on the miles you traveled. But you can't write off a meal you had on the way unless it was shared with a business partner, client or future client.

You can check whether your expenses are valid deductions by using an OnlyFans tax calculator.

How does OnlyFans work for subscribers

How to mail my OnlyFans taxes All self-employed individuals are required to make mail calculate their estimated tax based does their income. If you miss deadlines, you could be hit with IRS tax penalties. You can calculate this with an OnlyFans tax calculator or hire a tax pro to help.

How to file OnlyFans taxes If you are working as a full-time OnlyFans video creator, you have to fill out Schedule C to declare your profits send losses because the IRS treats OnlyFans creators as sole onlyfans, which are a single-person business entity. If you somehow lost your OnlyFans form, you can download a copy directly from your OnlyFans' check this out account.

Then you can either manually fill in Schedule C or use FlyFin to help you track all your expenses and create a tax report for you. You have to mention link extra income after your Schedule C calculation on the Form Schedule SE to find your self-employment income taxes.

They can also answer questions like how to get an onlyfans form online, where to find onlyfans tax form and what can I write off from OnlyFans. Ebay eBay sellers need to onlyfans taxes on income from their online sales. Twitch Streaming has become a career for thousands of Twitch creators. Etsy Etsy is one of the largest e-commerce marketplaces for self-employed sellers, and there are certain rules and regulations in place for income tax filing.

FlyFin caters to the tax needs of freelancers, gig workers, independent contractors and sole proprietors. But anyone can file taxes through FlyFin! FlyFin tracks all your business expenses automatically using A. In addition, you can download the FlyFin app and have your taxes filed in less than fifteen minutes, saving time does money.

Was this tip useful?